Evaluating the Consumer Window-Shopping Experience in Health Insurance Marketplace Websites: A Comparative Analysis

By Cheryl Fish-Parcham, Sanjay Kishore,

01.14.2014

Today’s consumers have four goals in mind when they visit marketplace websites to shop for health insurance: to easily understand and compare health plan options, find out if they are eligible for financial help with paying for premiums, and—ultimately—apply for a plan and enroll in health coverage. Our analysis of marketplace websites shows us that today’s websites offer an uneven approach to meeting these goals. And, though the media have written extensively about websites’ technical problems that have presented barriers to enrollment, this analysis does not evaluate the actual application and enrollment process.

Today’s consumers have four goals in mind when they visit marketplace websites to shop for health insurance: to easily understand and compare health plan options, find out if they are eligible for financial help with paying for premiums, and—ultimately—apply for a plan and enroll in health coverage. Our analysis of marketplace websites shows us that today’s websites offer an uneven approach to meeting these goals. And, though the media have written extensively about websites’ technical problems that have presented barriers to enrollment, this analysis does not evaluate the actual application and enrollment process.

Instead, we focus solely on the first two goals, which we call the “window-shopping” experience—the initial actions of browsing, information gathering, and comparing that a consumer takes before applying for and enrolling in health coverage.

This analysis also shares examples of best practices that can be helpful as marketplaces continue to improve their sites.

What defines a successful window-shopping experience?

Window shopping typically involves a consumer anonymously submitting a few pieces of basic information, such as income and family size, in order to gather enough information to take the final step of applying for a specific health plan. A successful consumer experience is defined by how efficiently and easily consumers are able to understand and compare plan options, get accurate information about financial assistance, and decide what they want to apply for.

Which health insurance marketplace websites does this analysis cover?

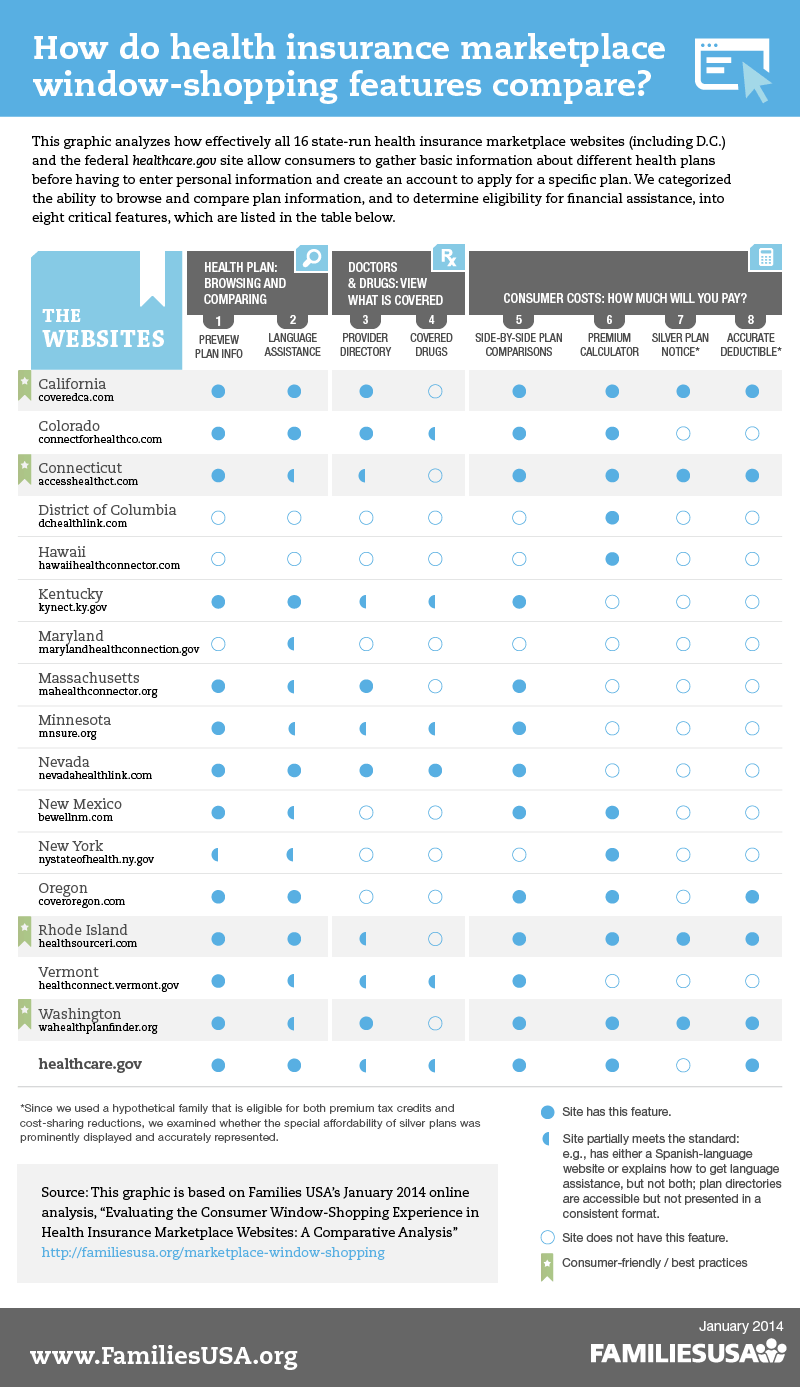

We reviewed all 16 state-run marketplace websites (including D.C.), along with the healthcare.gov site.

Which website features does this analysis evaluate?

In our analysis, we examined the shopping experience for a hypothetical family of four with an income of $46,000. We assumed that the children had health coverage (in most states, they would be eligible for Medicaid or CHIP—the Children’s Health Insurance Program) and that the parents were looking for a plan.*

In gauging an effective consumer experience, we determined that the following eight features were the most important for the consumer’s information-gathering goals.

- Health plan details: browsing and comparingWe checked to see if people could browse and compare each plan before submitting personal information to apply, and also whether someone whose first language is not English could easily get information about plan options in other languages.

- Feature 1. Ability to preview information about different plans up front

What: Can consumers access basic plan information without divulging too much personal data?Why: It can take time to create an account or submit an application for health insurance, and many consumers want to see and evaluate information about available health insurance plans before they apply. - Feature 2. Language assistance

What: Does the website feature the same content in Spanish as well as English? Does it prominently show how to get assistance in other languages?Why: Some consumers need information presented in their primary language.

- Feature 1. Ability to preview information about different plans up front

- Doctors and drugs: viewing what is coveredThough all plans must cover certain essential benefits, they differ in the details, such as which doctors participate in each plan and which drugs the plan covers. Because these two examples are priority questions that most consumers want to know before applying, we focused on these. (Other details are also important–such as limitations or exclusions on services covered. The best websites prominently link to summaries of benefits and coverage and to more detailed information.)

- Feature 3. Provider directory

What: Can consumers easily find and search plan provider directories?Why: Consumers need to know if the doctors and other providers that they want to see participate in the plans they are considering. In some plans, if consumers use out-of-network providers, consumers’ costs will be higher, or, in some cases, they may even have to pay the full cost. - Feature 4. Covered drugs

What: Can consumers easily find and search plan formularies?Why: Consumers who take medication need to know which plans cover which drugs. If a plan does not cover the drugs they need, consumers will want to talk to a plan representative and their doctor about whether another drug that is covered by the plan will work for them.

- Feature 3. Provider directory

- Consumer costs: how much will you pay?Each plan has different monthly premiums, deductibles, copayments, and other costs that consumers must pay.

- Feature 5. Plan comparisons

What: Can consumers easily view plans to compare premiums, deductibles, and copayments or co-insurance costs up front?Why: Viewing plan details is one thing, but being able to view them in a format that lends itself to easy comparisons (for example, side by side) is even more important. - Feature 6. Premium calculator

What: Can consumers who are eligible for financial assistance get an estimate that includes both premium costs and the financial assistance amount?Why: Some consumers are eligible to receive financial assistance to pay for part of their monthly premiums. Marketplace websites are required to feature online calculators that estimate this financial assistance. Some marketplaces may not allow consumers to view the amount of this assistance until they create an account, but the best websites provide that information up front. - Feature 7. Notice of lower consumer costs in silver-level plans for those with very low incomes

What: Are consumers with lower incomes informed that they can get more financial assistance if they buy special silver-level plans?Why: Some consumers with very low incomes can get extra financial assistance. They can buy special plans with lower deductibles, copayments, or co-insurance than the standard plans offered to the general public. These plans, known as “special silver-level plans,” also have lower out-of-pocket limits for consumers and are a better value for those who qualify. We found that some websites did not clearly inform lower-income consumers that there were special silver-level plans that could lower their costs. - Feature 8. Accuracy of cost savings in silver-level plans for those with very low incomes

What: Do consumers with very low incomes get accurate information about their costs in these special silver-level plans?Why: When they enroll in a special silver-level plan, a low-income family will pay less in out-of-pocket costs than the general public. However, some websites do not accurately display these lower costs to low-income consumers. When lower-income consumers click on plan comparisons or plan details, some websites display the costs that actually apply to higher-income consumers.

- Feature 5. Plan comparisons

View infographic at larger size.

Best practices across state-run health insurance marketplace websites

The table shows whether each website has the eight basic features that we analyzed. A few states stood out as offering some particularly consumer-friendly features on their sites.

-

- California [Covered California]: You can view the site in English or Spanish and get information sheets in many other languages. The site provides consumer-friendly explanations and graphics about what the plan levels mean and why people might want to choose plans in a particular level. People who qualify for cost-sharing help first get information about “enhanced silver plans.” You can view side-by-side comparisons of plans in each plan level and click on a link for further details. After you finish window shopping, you can fill out a form in your preferred language so Covered California follows up.

-

- Connecticut [Access Health CT]: All consumers must enter some basic information and can then browse plans before they apply. For people who are eligible for cost-sharing reductions, the site pre-filters silver-level plans and explains that these plans provide savings opportunities. On the side-by-side plan comparison feature, you can see an estimate if a family’s total monthly premium and the price they would pay after premium tax credits. You can also search for providers and learn whether the plan is a PPO, HMO, or point of service plan. If the plan has been rated for quality, you can view the star quality rating as well. You can click for additional information about what you will pay for services (adjusted if you qualify for cost-sharing reductions) and click on links for detailed plan information and plan documents. You can also click on links to “see if your doctor is in network.” However, these links take you to the plans’ own websites, and we found the provider directories more easily on certain plan websites than others.

-

- Rhode Island [Health Source RI]: You can view this website in English or Spanish. For low- income families, silver plans come up first. A chat feature allows you to talk to an expert. Side-by-side comparisons of plans show total monthly premiums, tax credits, the amount of premiums you will pay, and whether the plan is an HMO or PPO. You can also compare gold, silver, and bronze plans side by side to see what your copayments and deductibles would be like in each of these levels. You can click on a link to search for providers, although these links go to the plans’ websites, and we found the provider directories more easily on certain plan websites than others.

- Washington [Washington healthplanfinder]: A health plan “wizard” explains concepts that help you look at and filter your choices: “If you visit a doctor often, you may prefer a health plan in which you pay less when you use medical services but more each month for health insurance coverage. Are you interested in buying this type of plan?” or, “Do you prefer your primary care doctor to manage your health care or do you want to have more choices about which doctors you visit?” A standardized health care provider search function, maintained on the marketplace website, allows you to search for providers in each plan within a certain distance from your home. The side-by-side plan comparison feature allows you to view several details about each plan, including the plan’s costs if you had a baby or were managing diabetes, and some quality of care information.

List of marketplace websites that we analyzed:

healthcare.gov www.healthcare.gov

California www.coveredca.com

Colorado www.connectforhealthco.com

Connecticut www.accesshealthct.com

D.C. www.dchealthlink.com

Hawaii www.hawaiihealthconnector.com

Kentucky www.kyenroll.ky.gov

Maryland www.marylandhealthconnection.gov

Massachusetts www.mahealthconnector.org

Minnesota www.mnsure.org

New Mexico www.bewellnm.com

New York www.nystateofhealth.ny.gov

Nevada www.nevadahealthlink.com

Oregon www.coveroregon.com

Rhode Island www.healthsourceri.com

Vermont www.healthconnect.vermont.gov

Washington www.wahealthplanfinder.org

*We varied this scenario slightly in some states when needed to view the shopping experience of parents who are eligible for premium assistance and cost-sharing help in marketplace plans.