Designing Silver Health Plans with Affordable Out-of-Pocket Costs for Lower- and Moderate-Income Consumers

By Lydia Mitts,

05.12.2014

On May 14, Families USA released new research examining access to care for consumers with high out-of-pocket costs.

Many low- and moderate-income consumers can’t afford to pay the full cost of a routine doctor’s visit on their own. If deductibles are too high, the cost can deter these consumers from getting the care they need.

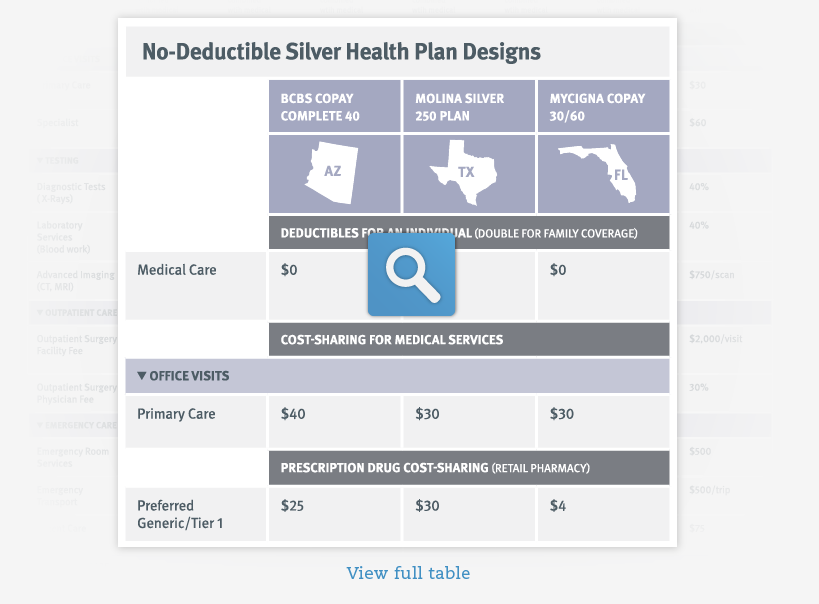

In the health insurance marketplace, low- and moderate-income consumers who use premium tax credits tend to buy silver plans. But unfortunately, recent analyses show that these types of plans typically have high deductibles. Our original research shows that it doesn’t have to be this way—insurers can choose to create silver plans with upfront cost-sharing amounts that are lower than those in high deductible plans.

Our brief, “Designing Silver Health Plans with Affordable Out-of-Pocket Costs for Lower- and Moderate-Income Consumers” (PDF) features:

- original research identifying existing silver plan designs that make the upfront cost for care more affordable

- policy and advocacy strategies to help advocates and policy makers effectively promote similar plan designs in other marketplaces across the country