Under House Bill Consumers Will Pay More For Less

By Lydia Mitts,

03.20.2017

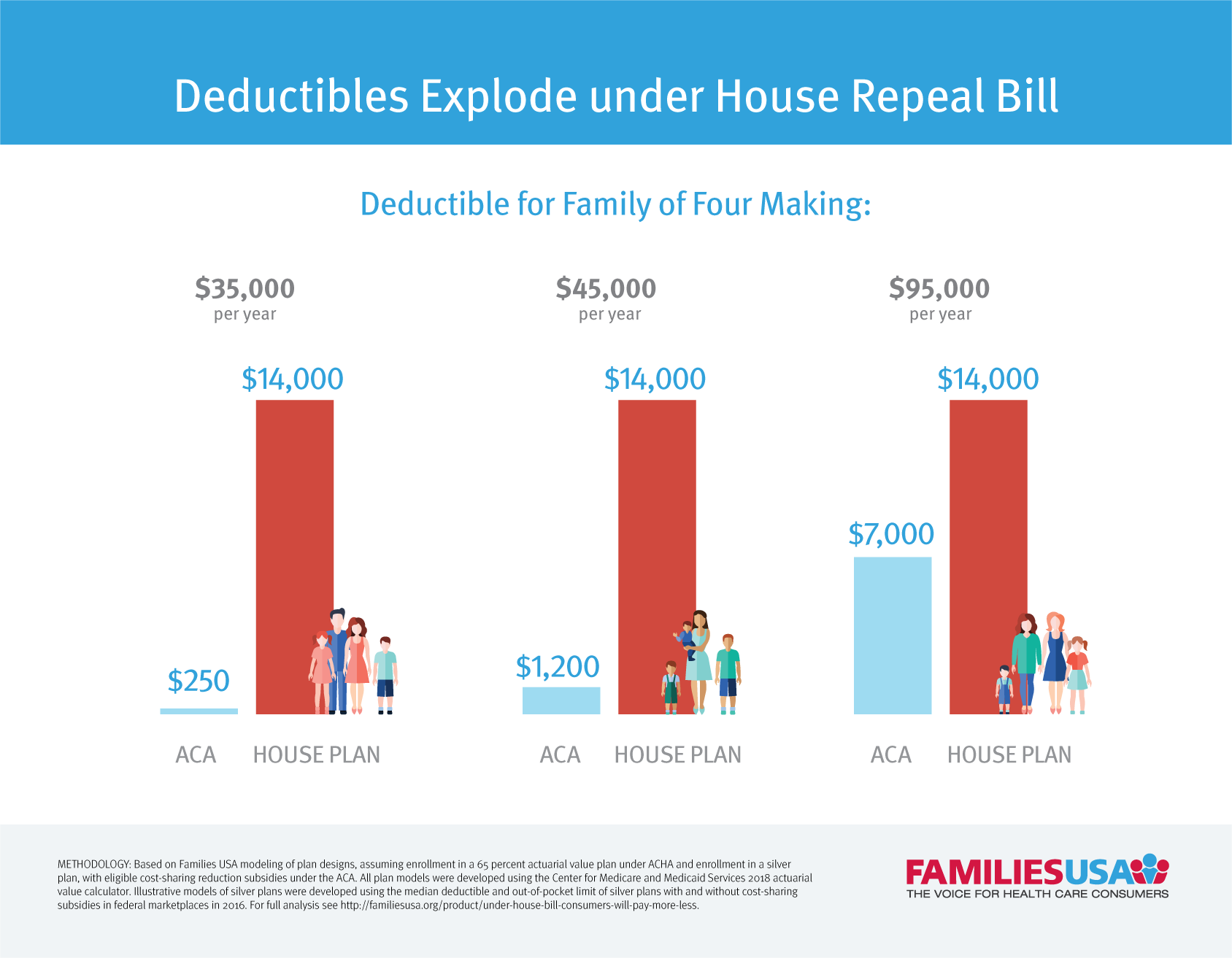

There are countless sobering findings in the Congressional Budget Office’s (CBO) assessment of the House GOP repeal bill, most importantly that the bill would lead to 24 million people losing health insurance. In addition to taking away coverage from millions of people, CBO also found that this bill would move the remaining insured into skimpier coverage, with much higher cost-sharing than they have today. This is in part because the bill would completely eliminate the Affordable Care Act’s financial assistance that helps people afford their deductibles and copays—known as “cost-sharing”—and would allow insurers to sell plans that force consumers to pay even higher deductibles and co-pays than they do now (“increased cost-sharing”). It also is due in part to the fact that this bill would drastically cut financial assistance with premiums, leaving many people only able to afford cheaper plans that come with much higher out-of-pocket costs.

House Repeal Bill Would Push Millions into Skimpier Plans

To be specific, CBO estimates that under the GOP repeal plan, by 2026, the average actuarial value of plans purchased on the marketplace would be only 65 percent. Actuarial value may seem like a complicated term, but it has very real importance. In its simplest explanation, actuarial value is the measure of how generous a plan is. The lower a plan’s actuarial value, the higher it’s cost-sharing—or cost to consumers—like deductibles, copays and coinsurance.

Today, the vast majority of people with marketplace coverage—8.5 million people—are enrolled in silver plans. Of those, 7 million also get financial assistance to further reduce cost-sharing in their silver plan. While there are numerous ways that insurers could design a health plan with a 65 percent actuarial value, it is a foregone conclusion that such a plan would have significantly higher out-of-pocket costs than the coverage that these 8.5 million people have today. This is simply because silver plans have a higher actuarial value. When you add in the financial assistance most of these people receive to further reduce cost-sharing in a silver plan (and, in effect, increase their plan’s actuarial value), the difference between a 65 percent actuarial value plan and the level of coverage people have today only grows.

Exactly how much would cost-sharing for consumers be in a plan with a 65 percent actuarial value, and how much higher would it be compared to the coverage people have under the Affordable Care Act? Families USA modeled three hypothetical plans designs that have a 65 percent actuarial value as an illustration of how high of cost-sharing could be for consumers in such plans. We modeled:

- A plan that pays for no care at all before a person pays her full deductible, and then pays 100 percent of a person’s medical care after the deductible is paid.

- A plan that covers only generic drugs and a limited number of primary care visits before a person pays their full deductible.

- A plan that covers all doctor’s visits (including primary care, specialty care and mental health care) before a person pays their full deductible.

The findings are stark: A 65 percent actuarial value plan—the kind envisioned in the House GOP repeal bill—that only covers doctor’s visits before the deductible could easily have a $7,000 deductible. This means people wouldn’t get any help paying for hospital care, prescription drugs, maternity care, or any other services outside of their doctor’s visits until they paid $7,000 out-of-pocket.

| 65 % AV Plan Design 1 | 65% AV Plan Design 2 | 65% AV Plan Design 3 | |

|---|---|---|---|

| Deductible | $5,000 | $6,000 | $7,000 |

| Out of Pocket Limit | $5,000 | $7,350 | $7,350 |

| Coinsurance | NA | 50% | 50% |

| Care Covered Before Deductible | Nothing | 5 primary care visits and generic drugs | All doctor’s visits |

| Actuarial Value | 65.12% | 64.94% | 65.21% |

*All plan designs were modeled using the Centers for Medicare and Medicaid Services 2018 actuarial value calculator. Deductibles listed are for an individual and would be doubled for family level coverage. Under modeled plans, care covered before the deductible is covered with no cost-sharing. Doctor’s visits covered before the deductible include primary care, mental health care, and specialty care office visits.

How House Repeal Bill Would Increase Out-of-Pocket Costs by Thousands of Dollars

This is drastically higher cost-sharing for consumers compared to today’s standard silver plans and current silver plans with cost-sharing assistance under the ACA. To facilitate apples-to-apples comparisons, we developed examples of a silver plan without cost-sharing assistance, and a silver plan at each level of cost-sharing assistance currently provided under the ACA. We designed these plans using the median deductibles and out-of-pocket limits for silver plans, with and without cost-sharing assistance for consumers, in 2016.

Using these modeled silver plans, we found that switching to a 65 percent actuarial value plan with a $7,000 deductible would mean a huge increase in out-of-pocket costs for people.

- People making only $17,000 a year would see their deductible skyrocket from $125 to $7,000. This translates into more than a 5000 percent increase in a consumer’s deductible. On top of this, their coinsurance payments would increase from 30 percent to 50 percent.

- People making $45,000 would face double the deductible, compared to a silver plan.

In total, these examples paint a picture of the drastic increase in health care costs people could face under the House repeal bill. In addition to many lower income people and older adults having to pay higher premiums for coverage- everyone will also being getting far less coverage, with much higher cost-sharing. There are no winners under this scenario.

How House Repeal Bill Could Increase Cost-sharing for Marketplace Enrollees

| House Repeal Bill (AHCA): 65 percent AV plan | Affordable Care Act: Silver plan, with applicable cost-sharing assistance |

||||

|---|---|---|---|---|---|

| All income levels | Individuals making $17,000 | Individuals making $20,000 | Individuals making $25,000 | Individuals making $45,000 | |

| Deductible | $7,000 | $125 | $600 | $2,500 | $3,500 |

| Out of Pocket Limit | $7,350 | $650 | $1,850 | $5,000 | $6,500 |

| Coinsurance | 50% | 30% | 30% | 50% | 50% |

| Care Covered Before Deductible | All doctor’s visits | All doctor’s visits | All doctor’s visits | All doctor’s visits | All doctor’s visits |

| Actuarial Value | 65.21% | 94.37% | 87.25% | 73.76% | 69.78% |

*All plan designs were modeled using the Centers for Medicare and Medicaid Services 2018 actuarial value calculator. Illustrative models of silver plans were developed using the median deductible and out-of-pocket limit of silver plans with and without cost-sharing subsidies in federal marketplaces in 2016, based on Commonwealth Fund reported data. Deductibles listed are for an individual and would be doubled for family level coverage. Under modeled plans, care covered before the deductible is covered with no cost-sharing. Doctor’s visits covered before the deductible include primary care, mental health care, and specialty care office visits.