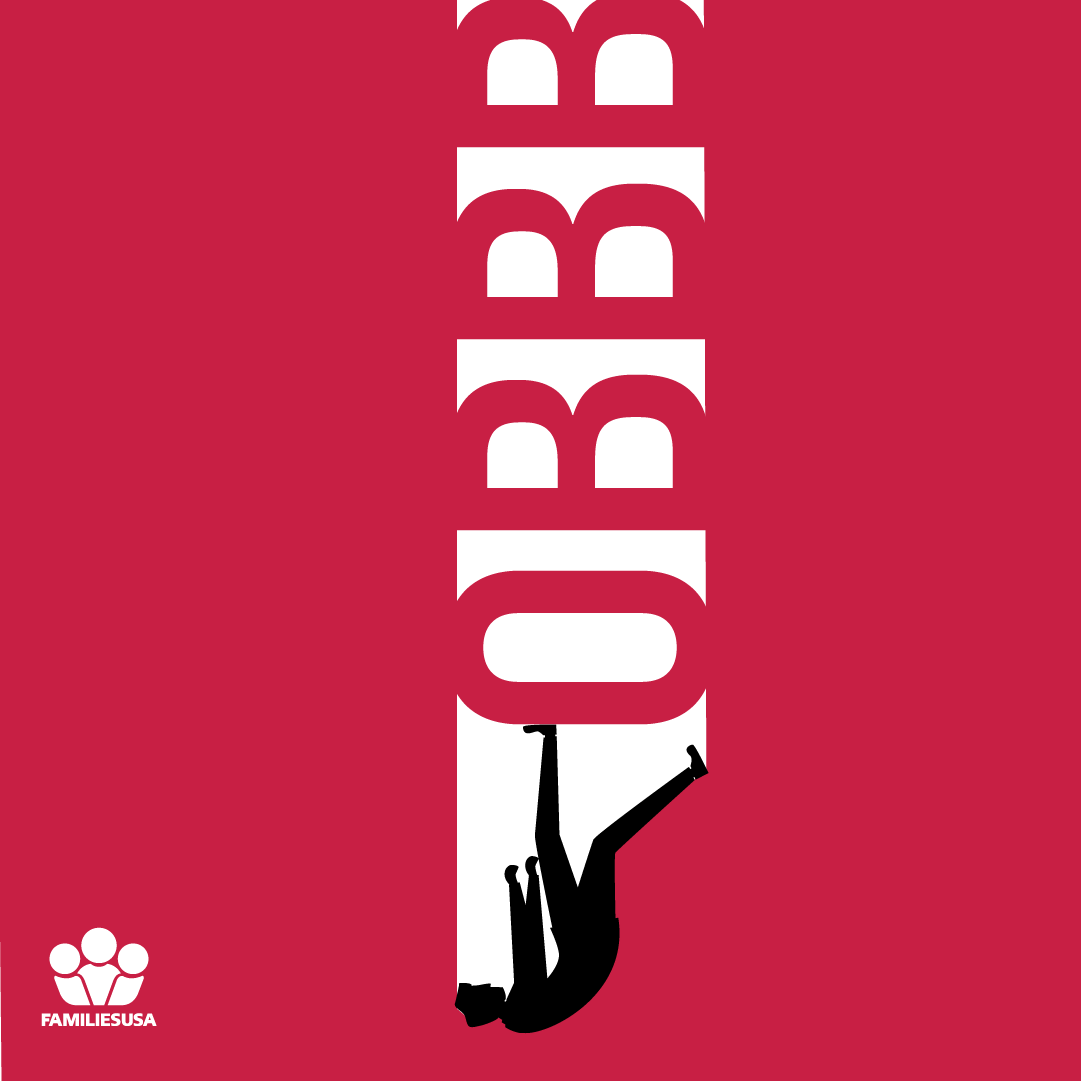

The Republican Tax Plan Opens the Door to Trillions in Health Care Cuts

By Dee Mahan,

11.03.2017

UPDATE 12/1: The Senate passed its tax bill that would increase the federal deficit by more than $1 trillion and repeal the individual mandate, which would kick 13 million people off of their coverage. Mostly by granting huge tax breaks to the wealthy and large corporations, the new tax bill would increase the federal deficit by $1.47 trillion over the next 10 years.

If a tax bill that explodes the deficit becomes law, it will set the stage for massive cuts to health programs like Medicaid, marketplace financial assistance, and Medicare. Health care consumers and their advocates thus need to pay careful attention to the tax debate.

Massive deficit increases could set the stage for later health care cuts

The tax bill is based on the Congressional budget resolution that passed in October on a party-line vote. That resolution authorized Congress to write a tax bill that increases the overall deficit by $1.5 trillion—and also to rush that bill through the Senate with only 50 votes, eliminating the need to seek any Democratic support.

Republican leadership is thus banking on nearly all Congressional Republicans setting aside their eight-year stated obsession with deficit reduction.

The tax bill itself could make massive health care cuts

During the tax debates, some members of Congress may demand the inclusion of health care cuts. The bill’s tax cuts have a gross cost that far exceeds $1.5 trillion. As a result, Congress must find offsetting savings, through increasing other taxes or cutting spending. Moreover, many Congressional Republicans may demand additional savings to reduce the net deficit explosion below the authorized $1.5 trillion level. Either way, health care cuts are one obvious way to pay for tax cuts. Anticipating that step, the October budget resolution, which defined the tax bill’s budgetary rules, explicitly authorized including in tax legislation proposals “relating to repealing or replacing the Affordable Care Act.”

The huge deficits that result from tax cuts will become an excuse for equally huge cuts in health care

Even if the tax bill itself leaves health programs alone, such a bill’s passage would threaten to take health insurance away from millions of families in America. A federal deficit increase of anything close to $1.5 trillion would give Congressional Republicans an excuse to quickly return to pious pronouncements about the need for fiscal responsibility and deficit reduction.

When that happens, Medicaid, the Affordable Care Act (ACA), and Medicare will all become prime targets for Republicans looking to plug the fiscal hole they just created. Such a fiscal hole would give President Trump and his Congressional allies more political cover to achieve what they were not able to accomplish this fall: gut Medicaid and repeal the ACA.

For example, when Senator Graham (R-SC) was trying to persuade wavering Senators to support his ACA-repeal bill, he claimed that the proposal’s massive Medicaid cuts and restructuring represented as good a deal as states could possibly get. His rationale? On its current path, he argued that Medicaid was “fiscally unsustainable.” A deeper federal deficit would simply make such claims more urgent.

It is surely no coincidence that the tax bill’s $1.5 trillion cost is almost precisely offset by health care cuts contained in multiple proposals to repeal the ACA and slash Medicaid:

- President Trump’s budget proposed $1.25 trillion in savings from repealing the ACA and cutting Medicaid.

- The Medicaid cuts in the House’s health care bill, the American Health Care Act (AHCA), and President Trump’s budget (which assumed the AHCA had passed) totaled nearly $1.7 trillion

- In its advisory spending targets, the partisan budget resolution Congress passed in October included $1.8 trillion in cuts to health care spending

Health care consumers and advocates have a huge stake in the tax debate. Either within its four corners or soon after its enactment, the Republican tax plan would fund huge tax breaks for millionaires, billionaires, and large corporations by slashing health care programs that serve the poor and middle class. Those who care about health and health care must prepare to weigh in at critical times to prevent the tax bill’s massive and grotesque upwards transfer of wealth, which would endanger health insurance for tens of millions of people.