The American Health Care Act Fails America

03.17.2017

Republicans in the House of Representatives moved forward this week to repeal the Affordable Care Act (ACA) by introducing the American Health Care Act (AHCA). Rather than build on the ACA’s historic progress, House Republicans are moving forward with plans to “replace” the ACA in ways that would instead jeopardize the health care of millions. Beyond this, the bill would radically restructure the entire Medicaid program, essentially ending Medicaid as it exists today.

If the Republicans are successful in moving forward with the AHCA:1

- An estimated 24 million people will lose coverage by 2026.

- $880 billion in federal funding will be cut from the Medicaid Program and 14 million fewer people will have Medicaid coverage in 2026.

- Financial assistance for premiums as well as costsharing for lower- and moderate-income families will be gutted, and premiums for older adults will further increase by thousands of dollars.

- Billions of dollars in tax cuts will be given to the wealthy and billion-dollar corporations at the expense of lower- and moderate-income families and the Medicaid program.

Using eight criteria we put forth to judge any ACA “replacement” plans, we have evaluated the AHCA and found that it falls substantially short in providing the same level of coverage, access, and affordability as the ACA. Despite promises to “leave no one worse off,” this plan, if passed, would destroy the health care lifeline upon which millions depend. This is not a replacement for the ACA and should be rejected.

Criteria 1: Preserve the coverage gains made to date and further decrease the number of people in this country without health insurance

How AHCA Falls Short: Millions would lose health care coverage

House Republicans initially insisted on rushing their bill forward with no official estimates of the effect on consumers. It is now clear that 24 million people would lose coverage and the coverage gains under the ACA would be erased.2

- 14 million people would lose coverage by 2026 because of the bill’s effective end of the Medicaid expansion. Without the increased federal funding provided to states under the ACA’s Medicaid expansion, many states will drop coverage for lowincome adults.

- A sizeable portion of lower-income people who have gained private coverage under the ACA would lose coverage due to the bill’s significant cuts to financial assistance to help people pay their premiums. The vast majority of people currently enrolled in the marketplace rely on the financial assistance under the ACA to afford coverage. Millions of people would see their financial assistance cut dramatically under this bill, leaving many unable to afford coverage (see Criteria 3 below).

- The ACA has given coverage to 20 million people and has led to the uninsured rate being historically low at 8.9 percent. This plan would take us backward by reversing those gains, and it would lead to 19 percent of non-elderly adults being uninsured by 2026.

Criteria 2: Ensure that health coverage is at least as comprehensive as what people have under the ACA

How AHCA Falls Short: Medicaid and private insurance would cover less, require enrollees to pay more out of pocket for needed care

The House Republicans’ bill would allow private insurers to sell plans with even higher deductibles, copayments, and other cost-sharing than the current floor set by the Affordable Care Act, which is bronzelevel coverage. This would put access to covered benefits financially out-of-reach for many. Insurers would also no longer have to sell plans that fall within the four metal levels created by the Affordable Care Act—bronze, silver, gold, or platinum plans.

- Having “coverage” for care, from prescription drugs to maternity care, is an empty promise if the only affordable plan comes with a deductible that’s more than $7,000.

- Under this bill, more plans would require high deductibles, copayments, and cost sharing. In addition, lower- and middle-income consumers would no longer receive assistance to pay these costs (See Criteria 3 below).

- It is likely that plans that have reasonable out-ofpocket costs would become significantly more expensive, as healthy, young people move into even less generous coverage. As a result, many people who need comprehensive coverage will no longer be able to find or afford coverage that truly puts covered benefits financially in reach.

The bill would also put covered benefits in jeopardy for individuals and families who rely on Medicaid.

- It proposes to fundamentally reconfigure traditional Medicaid with a per-capita cap funding structure, which could put Medicaid benefits at risk. Per-capita caps are cuts that shift costs on to states. In response, states may drop vital services or increase cost-sharing for enrollees. This could leave the most vulnerable members of society and those with limited financial resources without access to essential services like prescription drugs and home care, or force higher out-of-pocket costs for such services.

Criteria 3: Ensure that premiums and cost-sharing—like deductibles and copays—are at least as affordable as under the ACA

How AHCA Falls Short: Premiums and cost-sharing for millions of lower- and moderate-income people will increase

The House Republicans’ bill would end in 2020 the income-based premiums tax credits provided under the ACA and replace them with flat tax credits between $2,000 and $4,000. These tax credits would increase with people’s age, but would not change based on people’s income for anyone making up to $75,000 ($150,000 for a couple).3 Under this new tax credit, lower-income people and older people would see significant cuts to their financial assistance to help pay premiums. The bill would also completely eliminate financial assistance provided under the ACA to reduce out-of-pocket costs, like deductibles, starting in 2020. As a result, millions would see their premiums and out-of-pocket costs like deductibles, copays, and coinsurance increase dramatically.

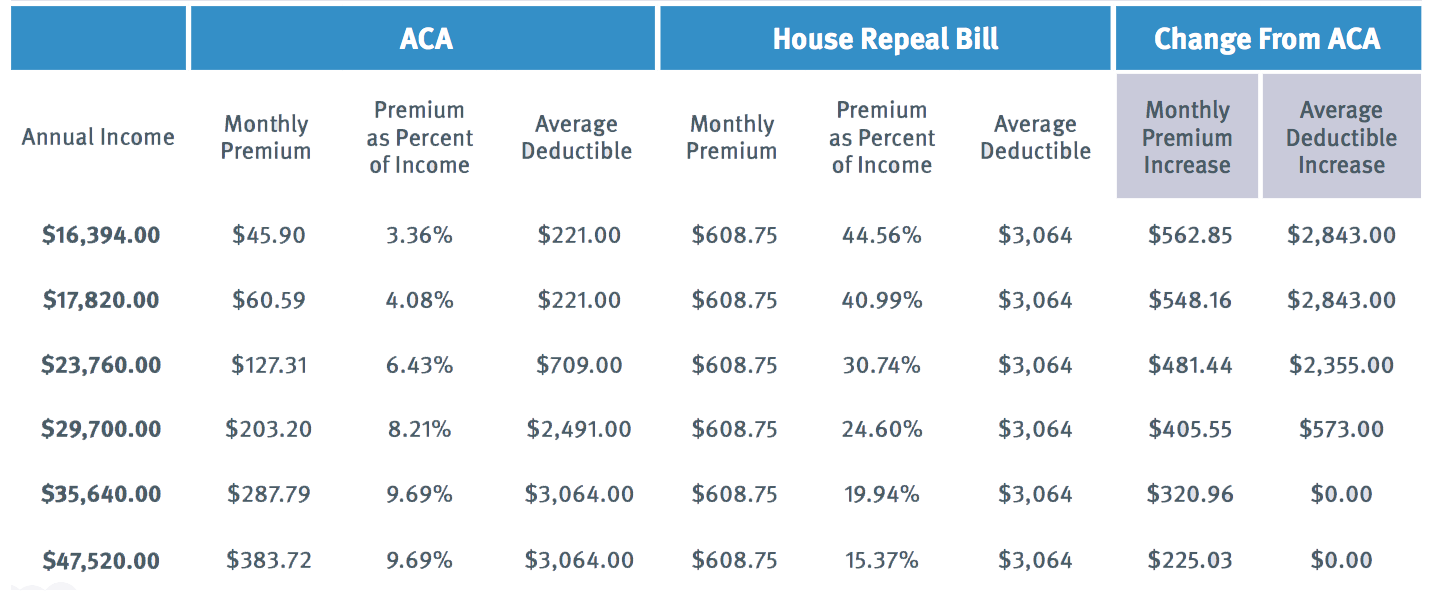

Here’s the breakdown on how much lower- and moderate-income people could see their costs increase:

- The average marketplace enrollee’s yearly health care costs would increase $1,542.4

- Compared to the cost of a silver plan this year, 60-year-old individuals would see their monthly premiums increase between $225 and $563, depending on their income5 (See Table 1).

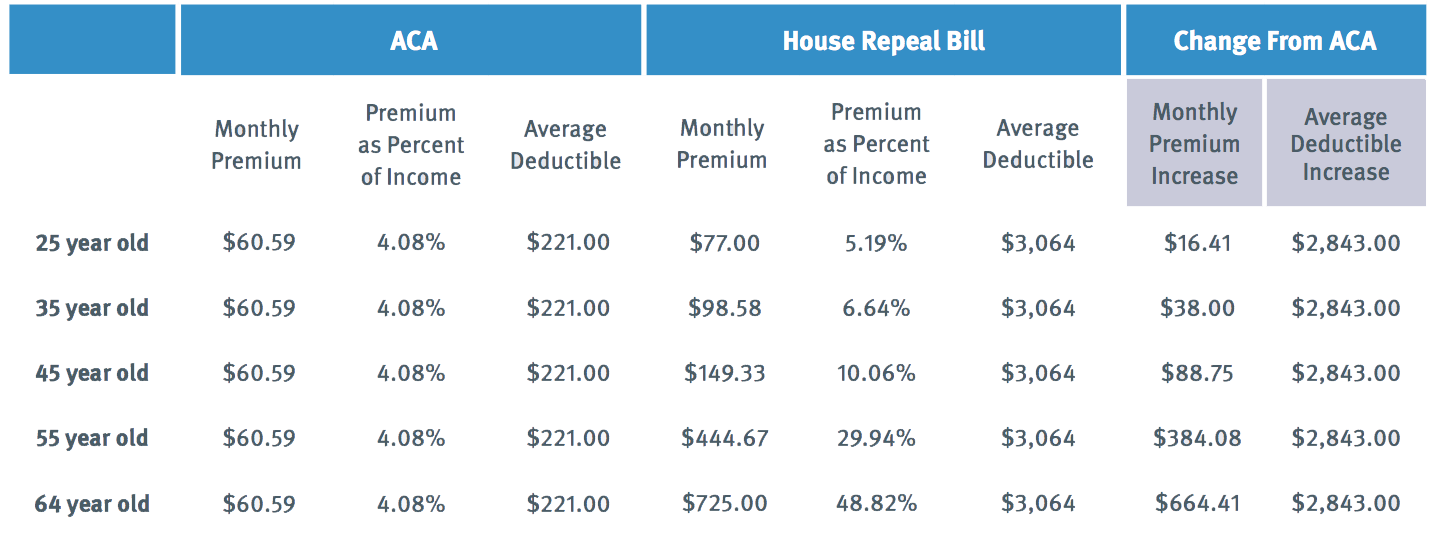

- Individuals making just under $18,000 a year would see their monthly premiums for a silver plan in 2017 increase between $16 and $641, with lower-income seniors seeing the biggest increase in premiums6 (See Table 2).

- 7 million lower-income people would lose assistance to reduce their out-of-pocket costs, like deductibles, coinsurance, and copays. On average, these people’s deductibles would increase between $573 and $2,843, depending on their income.7

- Without cost-sharing assistance, individuals making less than around $18,000 a year would see their deductible increase from $221, on average, to more than $3,000. And this assumes that they are still able to afford the same plan they have now (See Table 2).

- In reality, many of these people would no longer be able to afford their current plan once their help with premiums is cut and would be left only able to purchase skimpier coverage with even higher cost-sharing.

Criteria 4: Ensure that the Medicaid and Children’s Health Insurance Program (CHIP) safety-net continue to provide affordable, comprehensive health coverage for all lowincome families who are currently entitled to it

How AHCA Falls Short: The Medicaid expansion would end and the Medicaid program would be radically restructured. In total, it would cover 14 million fewer people and cut $880 billion in federal funding from the program.

The House Republicans’ bill would radically change the structure of the Medicaid program, end the popular Medicaid expansion, and begin the process of unraveling important consumer rights and protections.

- The bill would fundamentally change the state-federal funding structure of the Medicaid program. In its place, the proposal institutes a per capita cap system, which puts a ceiling on federal funding for a state Medicaid program, even if actual costs exceed the ceiling. The bill’s proposed on-size-fits-all inflation adjustment is projected to be less than actual state costs. This cost shift to the states will put more fiscal pressure on states and put health care for kids, long term care for seniors, and home care for people with disabilities at risk.

- The shift to a per capita cap is the first step toward unraveling the underlying entitlement structure of the Medicaid program. States would be unable to absorb the large cuts in federal funding instituted by the cap without flexibility from the federal government to impose cost-saving measures like implementing waiting lists for enrollment.

- This bill would phase out the Medicaid expansion, effectively ending it in 2020. After 2020, any expansion enrollee who has a break in coverage of one month—for example if his or her income temporarily increases due to seasonal work—would be at risk of losing access to Medicaid permanently, even if he or she qualifies in the future. As a result of the way this bill changes federal Medicaid funding for the expansion population, many states will ultimately drop coverage for low-income adults, leaving millions without health insurance.

- The bill removes the requirement that Medicaid expansion benefit plans cover all 10 essential health benefits. In practice, this could result in a loss of benefits for expansion enrollees.

Criteria 5: Protect people with pre-existing health conditions at all times from discrimination by insurers

How AHCA Falls Short: People with serious health conditions would be left with unaffordable coverage and higher health care costs

The House Republicans’ bill would allow insurers to charge people 30 percent higher premiums if they have a gap in coverage of just over 2 months. It also would allow insurers to sell plans with higher deductibles and cost-sharing. These two provisions would lead to many people with pre-existing conditions struggling to find affordable coverage that meets their needs.

- Tens of millions of people experience short lapses in coverage, including those with pre-existing conditions. Nearly one-third of people with preexisting conditions (44 million people) experienced a lapse in coverage over 2013 and 2014. Over 90 percent of these people were uninsured for at least 2 months.8 Most people lose coverage simply because they can’t afford it, and this is even more challenging for people who face such serious illness that they are not able to work. Charging these individuals 30 percent more for coverage could price millions of people with pre-existing conditions out of coverage.

- Increasing premiums 30 percent for the newly insured will also increase premiums for everyone who is already insured. This is because this policy will make it even harder to attract new young, healthy people into the insurance market, a concern even shared by insurers.9 As premiums increase for those already insured, comprehensive coverage will be unaffordable for those with pre-existing conditions who rely on insurance to afford treatment.

- Allowing insurers to sell plans with even higher cost-sharing will mean that comprehensive coverage with affordable cost-sharing will only become more expensive (see Criteria 2). This means that millions of people with pre-existing conditions may not be able to find affordable coverage that actually helps them afford the care they need.

Criteria 6: Prevent insurers from discriminating against women and older people

How AHCA Falls Short: Older people will face greater discrimination in premium pricing

The House Republicans’ bill would allow health insurers to charge older individuals premiums that are five times the rate of young people, a much higher differential than is allowed under the ACA. Even with the proposed tax credits, the amounts that lower and middle-income older people would be left to pay in premiums is much higher than what younger people pay, and much higher than what older people pay today.

- Under the House Republican plan, older people would be charged five times the premiums of younger people, increasing premiums for a 64-year-old by an estimated 29 percent, or $3,000 more than what they are charged today.10

- Yet the tax credit that lower-income and middle-income older individuals would get for health insurance under the House plan is far less than the amount they get now. The combined effects of higher premiums and less in tax credits would leave older individuals with exorbitant health insurance costs.

- For instance, with higher premiums and less in tax credits, a 60-year-old making just less than $30,000 a year would have to pay $4,867 more per year for a silver plan—that’s 25 percent of his or her annual income going toward paying monthly premiums. This stands in stark contrast to the 8 percent of income he or she pays now, with the help of financial assistance.11

Criteria 7: Ensure people have adequate assistance enrolling in and using their health coverage

How AHCA Falls Short: Consumers would have no guarantee that the assistance they need to enroll in and use health coverage will be available

The House Republicans’ bill makes no mention of providing assistance to consumers enrolling in and using health coverage, including help when consumers need to settle problems or disputes that arise with their enrollment or coverage. It is Congress’ responsibility to ensure that adequate resource are in place to help people enroll in coverage. Given recent actions by the Administration to hinder enrollment in coverage, it is incumbent that Congress take action to protect efforts to help people enroll in coverage.

- Nothing in the proposed plan takes proactive steps to prevent the Administration from taking harmful steps to undermine these critical programs. In fact, some of the first actions this Administration took were to pull back outreach activities aimed at ensuring consumers enrolled in coverage. Under this House Republican plan, HHS could continue on a similar destructive path.

Criteria 8: Ensure efforts to rein in health care spending tackle true drivers of health care spending, improve care quality, and never simply shift costs to consumers

How AHCA Falls Short: By shifting costs to states and consumers, this bill would cripple efforts to rein in overall health care spending

The House Republicans’ bill would substantially undermine efforts across the health care system to rein in health care spending, improve care quality, and improve population health. In fact, the bill has no strategy for cost containment or quality improvement and instead shifts substantially greater financial risk to states and consumers.

- Rather than address underlying costs, the bill gives billions of dollars in tax cuts to the wealthy and billion-dollar corporations. These tax cuts for the rich would be paid for by taking health care away from lower-income working families and putting at risk the health care of millions of children, seniors, and people with disabilities.

- Millions of individuals would be at risk of losing coverage and would only have access to coverage that is unaffordable and/or does not meet their health care needs. Without access to affordable, comprehensive coverage, millions may be forced to go without needed care—putting their health in jeopardy and driving up health care costs across the system.

Checklist: How the AHCA Measures Up

| YES | NO | |

|---|---|---|

| Preserve the coverage gains made to date and further decrease the number of people in this country without health insurance. | ✓ | |

| Ensure that health coverage is at least as comprehensive as what people have under the ACA. | ✓ | |

| Ensure that premiums and cost-sharing—like deductibles and copays—are at least as affordable as those under the ACA. | ✓ | |

| Ensure that the Medicaid and CHIP safety net continue to provide affordable, comprehensive health coverage for all low-income families who are entitled to it under current eligibility standards. | ✓ | |

| Protect people with pre-existing health conditions at all times from discrimination by insurers. | ✓ | |

| Prevent insurers from discriminating against women and older people. | ✓ | |

| Ensure people have adequate assistance enrolling in and using their health coverage. | ✓ | |

| Ensure efforts to rein in health care spending tackle true drivers of health care spending, improve care quality, and never simply shift costs to consumers. | ✓ |

Table 1: 60 year old adults between 138% and 400% of poverty

Table 2: Individuals making just under 18,000 (150% of poverty)

TABLE METHODOLOGY: Analysis of premiums and deductibles, post financial assistance under the Affordable Care Act (ACA) and the American Health Care Act (ACHA). Premium estimates based on Kaiser Family Foundation data of the national average age-rated premiums for the second-least expensive silver plan, adjusted to assume 5:1 age ratings and application of premium tax credits under ACA or ACHA. Change in deductibles is based on average deductible for silver plans with and without cost-sharing reduction subsidies. SOURCE: Matthew Rae, Gary Claxton, Cynthia Cox and Michelle Long, Cost-sharing Subsidies in Federal Marketplace Plans, 2016, (Washington, DC: Kaiser Family Foundation, Nov 13, 2015).

Endnotes

1Congressional Budget Office, Congressional Budget Office Cost Estimate: American Health Care Act, (Washington, DC: Congressional Budget Office, March 13, 2017), available online at, https://www.cbo.gov/publication/52486.

2Congressional Budget Office, Congressional Budget Office Cost Estimate: American Health Care Act, (Washington, DC: Congressional Budget Office, March 13, 2017), available online at, https://www.cbo.gov/publication/52486. Namrata Uberoi, Kenneth Finegold, and Emily Gee, Health Insurance Coverage and the Affordable Care Act, 2010-2016 (Washington, DC: Office of the Assistant Secretary for Planning and Evaluation, March 2016), available online at https://aspe.hhs.gov/sites/default/files/ pdf/187551/ACA2010-2016.pdf. Emily P Zammitti, Robin A. Cohen, Michael E. Martinez, Health Insurance Coverage: Early Release of Estimates from the National Health Interview Survey, JanuaryJune 2016, (Hyattsville, MD: National Center for Health Statistics, November 2016), available online at https://www.cdc.gov/nchs/ data/nhis/earlyrelease/insur201611.pdf

3Under the American Health Care Act, tax credits would be gradually scaled down for people with annual incomes above $75,000 ($150,000 for a couple).

4David Cutler, John Bertko, Topher Spiro, and Emily Gee, Analysis of GOP Plan to Cost Obamacare Enrollees $1,542 More a Year, (Vox, March 7, 2017), available online at http://www.vox.com/thebig-idea/2017/3/7/14843632/aca-republican-health-care-planpremiums-cost-price

5Families USA analysis of change in premium tax credits under American Health Care Act based on Kaiser Family Foundation data of the national average age-rated premiums for the second-least expensive silver plan, adjusted to assume 5:1 age ratings. Analysis assumes individuals are enrolled in the second-lease expensive silver plan.

6Families USA analysis of change in premium tax credits under American Health Care Act based on Kaiser Family Foundation data of the national average age-rated premiums for the second-least expensive silver plan, adjusted to assume 5:1 age ratings. Analysis assumes individuals are enrolled in the second-lease expensive silver plan.

7Increase in deductible is based on average individual deductible for silver plans Matthew Rae, Gary Claxton, Cynthia Cox and Michelle Long, Cost-sharing Subsidies in Federal Marketplace Plans, 2016, (Washington, DC: Kaiser Family Foundation, Nov 13, 2015), available online at http://kff.org/health-costs/issue-brief/ cost-sharing-subsidies-in-federal-marketplace-plans-2016/

8Assistant Secretary for Planning and Evaluation (ASPE), Health Insurance Coverage for Americans with Pre-Existing Conditions: The Impact of the Affordable Care Act, (Jan 5, 2017) available online at: https://aspe.hhs.gov/system/files/pdf/255396/PreExistingConditions.pdf

9Blue Cross Blue Shield Association, Key Blue Cross Blue Shield Recommendations for the American Health Care Act (Blue Cross Blue Shield: March 7, 2017). http://big.assets.huffingtonpost.com/ BCBSAletterAHCA.pdf

10Evan Saltzamn and Christine Eibener, Insuring Younger Adults through the ACA’s Marketplaces: Options to Expand Enrollment, Technical Appendix, Commonwealth Fund, December 16, 2016, available on http://www.commonwealthfund.org/Publications/ Blog/2016/Dec/Insuring-Younger-Adults

11Families USA analysis based on 2017 national average premium for the second-least expensive silver plan, adjusted to reflect expected premium change using 5:1 age rating bands and changes in premium tax credit, using Health Insurance Marketplace Calculator (Washington, DC, Kaiser Family Foundation, November, 2016 and Impact of Changing ACA Age Rating Structure (Milliman, January 2017).