Repeal of the Affordable Care Act = A Huge Tax Cut for the Wealthy

12.20.2016

President-elect Trump and his congressional supporters have repeatedly said they will “repeal and replace” the Affordable Care Act (ACA). As a first step, they apparently plan to propose a “repeal-only” bill that is based on legislation Congress already passed and President Obama vetoed in January 2016.1 The effect repeal could have on people who have benefited from the Affordable Care Act has been well-documented as has the potential catastrophic effect it could have on the stability of the insurance system as a whole.

But there is one aspect of repeal that many are still unaware of: the repeal-only bill being contemplated by congressional leadership takes money originally intended to fund health coverage for middle-class and low-wage working families and gives it to the wealthy and large corporations in the form of huge tax cuts and tax breaks. Together, these entities would receive tax cuts worth nearly $600 billion—more than half a trillion dollars.

Key Findings

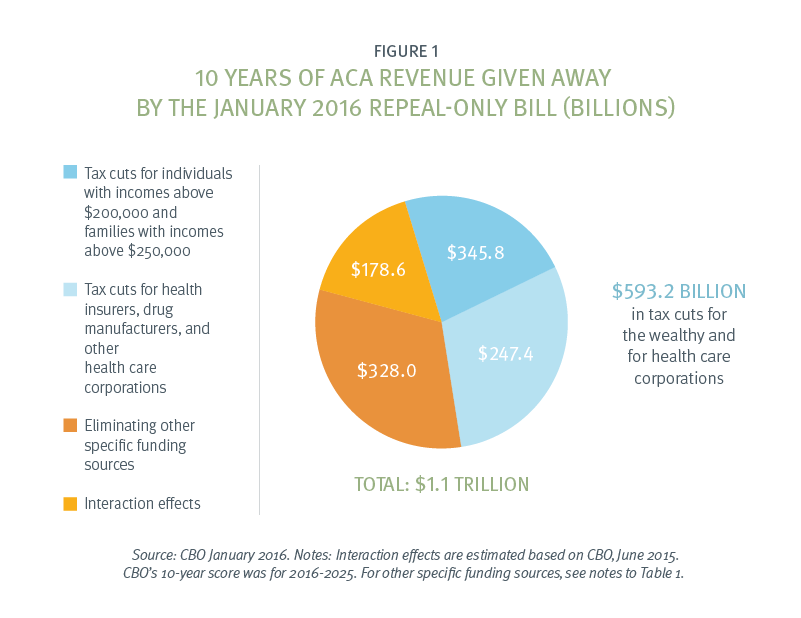

Under the 2016 legislation that will likely form the basis for 2017’s repeal effort, major corporations and the wealthy get new tax breaks worth $593.2 billion—more than half a trillion dollars over ten years (see Figure 1). This includes (see Table 1):

- $345.8 billion over ten years in tax cuts that are limited to people with incomes above $200,000.

- $247.4 billion over ten years for insurance companies, drug manufacturers, and other health care corporations.

If similar legislation is proposed in 2017, these tax giveaways will come with an even higher price tag, because of health care inflation and increased national income between January 2016 and 2017.2

What ACA revenue would the repeal-only bill give away?

Based on 2016 reconciliation legislation, the repeal-only bill would give away a total of $388.7 billion in revenue over five years and $1.099 trillion over ten years (see Table 1), a sizable portion of which would go to tax cuts for the wealthy and big corporations.

Immediate tax cuts for the wealthy

- $136.4 billion and $345.8 billion over five and ten years, respectively, would go to individuals with incomes above specified thresholds—$200,000 for single individuals and $250,000 for families.

- The repeal-only bill would end the ACA’s payroll taxes and investment-income taxes that were limited to this specific group of high earners.

- These changes would go into effect immediately following enactment, several years before the coverage cuts.

Tax cuts for health insurance companies, drug companies, and others in the health care industry.

- Industry would get tax breaks totaling $71.5 billion and $247.4 billion, over five and ten years, respectively.

- The biggest winners would be insurance companies, which would receive tax cuts worth $49.3 billion and $197.8 billion over five and ten years, respectively. This includes regaining the ability to take a tax deduction for the cost of executive compensation that exceeds $500,000 a year.

- In second place are prescription drug manufacturers, gaining $16.1 billion and $29.6 billion over five and ten years, respectively.

- Like tax cuts for wealthy individuals, most of these corporate tax cuts would become effective when the bill passes.

Other tax cuts and funding losses.

Other fiscal losses would total $125.2 billion and $328.0 billion over five and ten years, respectively:

- The bill would give away $69 and $167 billion over five and ten years, respectively, by eliminating “employer responsibility payments.” When businesses offer inadequate or no health insurance, and their workers use publicly-funded health coverage as a result, this tax requires companies to partially repay the government for covering their employees’ health insurance costs.

- The bill would eliminate “individual responsibility payments” from those who remain uninsured despite being offered coverage. Lost revenue would total $19 billion over five years and $43 billion over ten.

- The bill would restore Medicaid payments for hospitals that serve a disproportionate share of uninsured and low-income patients. That would cost $7.2 billion and $37.5 billion over five and ten years, respectively. The ACA phases these payments down; as more individuals gain coverage, particularly through the Medicaid expansion, hospitals would have fewer uninsured patients, making these payments less necessary. The fact that the repeal bill restores this funding shows that repeal proponents clearly understand that their plan will requires hospitals to cope with a much larger number of uninsured who are unable to afford necessary hospital care.

- Beyond the direct federal revenue losses from the repeal-only bill’s tax give-backs,, there would be indirect effects on federal revenue as well. CBO anticipates some reductions in wages from ACA repeal. Those wage reductions would, in turn, reduce federal tax revenue. These so-called “interaction effects” involve revenue losses estimated at $55.6 billion and $178.6 billion over five and ten years, respectively.3

What ACA revenue would the repeal-only bill leave in place?

In June 2015, CBO estimated the effects of a total ACA repeal.4 CBO’s itemization of ACA revenue sources included several that were not touched by the 2016 repeal-only bill. These would remain in place:

- Lower payments to Medicare providers, totaling $228 billion and $802 billion over five and ten years, respectively, mainly involve hospitals, insurers, and home-care providers.

- Medicaid savings totaling $9.8 billion and $28.5 billion, over five and ten years, respectively, mainly involve discounts on prescription drug prices.

- ACA changes made to other health programs increase spending by $3 billion over five years and reduce it by $10 billion over ten.

Altogether, only 38 percent of the ACA’s five-year revenue and 43 percent of its 10-year revenue would remain intact, under the 2016 repeal-only bill (see Table 2). This is precious little funding to provide 30 million people with coverage remotely comparable to what they had before repeal.

Conclusion

Repeal-only is a huge tax cut for the wealthy and big corporations, based on past repeal bills that are likely to serve as the model for action in 2017. Moreover, those losing insurance are mostly from middle class and low-wage, working families. The repeal-only bill would take more than half a trillion dollars that these families need for their replacement insurance and give it to the wealthy and large corporations. This massive transfer of resources from the vulnerable middle class to the economic elite would betray “the forgotten men and women of our country” to whom President-Elect Trump paid homage on Election Day.

This makes it imperative for lawmakers to spell out the details of replacement coverage before they take health insurance away from more than one in ten non-elderly Americans. A vote for repeal-only, without saying anything about what replaces current insurance, would show appalling disregard for the affected families’ health care and economic security.

Table 1. ACA revenue given away by the January 2016 repeal-only bill (billions of dollars)

| Category of Revenue Loss | Specific Revenue Source | Revenue Loss | |

| Over Five Years | Over Ten Years | ||

| Tax cuts for families and individuals with annual earnings above $200,000 (single filers) or $250,000 (joint filers) | Taxes on Investment Income | $88.4 | $222.8 |

| Payroll Taxes | $48.0 | $123.0 | |

| Sub-total | $136.4 | $345.8 | |

| Tax cuts for health care industry | Insurance Companies | $49.3 | $197.8 |

| Prescription Drug Manufacturers | $16.1 | $29.6 | |

| Medical Device Manufacturers | $6.1 | $20.0 | |

| Sub-total | $71.5 | $247.4 | |

| Other specific sources | Employer responsibility payments* | $69.0 | $167.0 |

| Individual responsibility payments | $19.0 | $43.0 | |

| Medicaid DSH restorations** | $7.2 | $37.5 | |

| Other tax cuts | $30.0 | $80.5 | |

| Sub-total | $125.2 | $328.0 | |

| Interaction effects | $55.6 | $178.6 | |

| Total revenue losses, combined | $388.7 | $1,099.8 | |

Source: CBO, January 2016.

*”Employer responsibility payment” is a tax on business that provide inadequate or no health insurance and whose workers are receiving publicly-financed tax credits to pay for private insurance.

**This is a restored federal payment to hospitals that provide health care to a disproportionate number of low-income individuals who are uninsured and unable to pay for care. Restoring this funding is a recognition that with repeal, more people will be uninsured.

Notes: The five- and ten-year estimates are for federal fiscal years 2016-2020 and 2016-2025, respectively. “Other tax cuts” involve tax preferences for health- and medical-savings accounts, deductions for employer contributions to retiree drug coverage, the minimum threshold for tax deductions for household medical expenses, indoor tanning companies, and the economic substance doctrine. Individual- and employer-responsibility payments, revenue losses due to lower taxes on high-cost health insurance (which are included in this table as a tax cut for insurance companies), and interaction effects are estimated based on CBO, June 2015.5

Table 2. ACA funding eliminated by the January 2016 repeal-only bill vs. ACA funding left in place

| Over Five Years | Over Ten Years | |||

| $ (billions) | % | $ (billions) | % | |

| Total ACA funding for coverage expansion | $623.5 | 100% | $1,940.3 | 100% |

| ACA funding eliminated by January 2016 repeal-only bill | $388.7 | 62% | $1,099.8 | 57% |

| ACA funding not eliminated by January 2016 repeal-only bill | $234.8 | 38% | $840.5 | 43% |

Source: CBO, December 2015; CBO, June 2015.

Endnotes

1Robert Pear, Jennifer Steinhauer and Thomas Kaplan. “G.O.P. Plans Immediate Repeal of Health Law, Then a Delay.” New York Times, Dec. 2, 2016. http://www.nytimes.com/2016/12/02/us/politics/obamacare-repeal.html?hp&action=click&pgtype=Homepage&clickSource=story-heading&module=b-lede-package-region®ion=top-news&WT.nav=top-news&_r=0.

2However, those same factors mean that a 2017 bill’s revenue losses, as a percentage of total ACA funding, would rise by only a small amount.

3CBO’s estimates for the January 2016 reconciliation legislation did not separately distinguish budgetary effects of different coverage-related provisions, including these interaction effects. We estimate the latter based on the more detailed analysis in CBO. Budgetary and Economic Effects of Repealing the Affordable Care Act. June 2015. https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/reports/50252-Effects_of_ACA_Repeal.pdf. CBO described these effects as follows, without providing details: “Consists mainly of the effects on revenues of changes in taxable compensation. “ See note c to Table 2. Interaction effects will differ during the initial years of the reconciliation bill, since the reconciliation bill delays coverage reductions. We therefore exclude from the estimate in the text all interaction revenue losses before 2018; and for 2018, we impute a smaller interaction revenue loss, based on the reduced total projected fiscal impact of the January 2016 reconciliation bill’s coverage provisions, compared to the June 2015 projections. These assumptions almost certainly make the interaction effects shown in the text lower than what CBO included in its estimates for the January 2016 reconciliation bill.

4CBO, June 2015, op cit.

5We analyzed the impact of the Consolidated Appropriations Act of 2016 based on CBO. December 16, 2015. Table 2: Estimate of Effects on Direct Spending and Revenues of Divisions M through P of House Amendment #1 to H.R. 2029, as Posted on the Website of the House Committee on Rules on December 16, 20151, https://www.cbo.gov/sites/default/files/114th-congress-2015-2016/costestimate/hr2029amendment1divisionsa.pdf