President Trump’s ACA Changes Will Increase Costs to Consumers, Make It Harder to Enroll in Coverage

By Lydia Mitts, Caitlin Morris,

04.14.2017

Yesterday, despite overwhelming opposition from consumers and a variety of other stakeholders, the Trump Administration finalized proposed changes to the individual health insurance market for 2018 that will increase costs for consumers, reduce financial assistance to help consumers afford coverage, and make it harder for people to enroll in coverage through the marketplaces.

In its first regulatory act, the Trump Administration has laid the groundwork to ensure that “TrumpCare” will cost consumers drastically more, if they are able to sign up for health insurance at all. This tips the balance in favor of insurers at the expense of consumer protections.

More than 4,000 people submitted comments during the public comment period for the proposed rule. The vast majority of these comments were from individual consumers urging the Administration to protect the Affordable Care Act (ACA), strengthen it administratively, and reject regulatory changes that would make coverage more expensive and care more difficult to obtain. This level of public engagement is astonishing, especially considering the Administration’s attempt to suppress meaningful comments by offering only a 21-day comment period, a departure from standard procedure. The Trump Administration ignored these outcries and instead finalized a set of policies that will exact serious harm.

PRESS RELEASE: Trump Breaks His Promise Again: Makes it Harder for Families to get Affordable Health Care

Billed by the Trump Administration as necessary for “marketplace stabilization,” the set of finalized policies is anything but. Combined with the uncertainty injected into the market by the ongoing threat on Capitol Hill of repealing the ACA, these new policies will only further undermine the stability of the individual insurance market. They will also weaken coverage and financial assistance for millions of individuals who rely on the health insurance marketplaces that the ACA created.

Here’s how the policies finalized in this rule will harm consumers in the marketplace. The final rule:

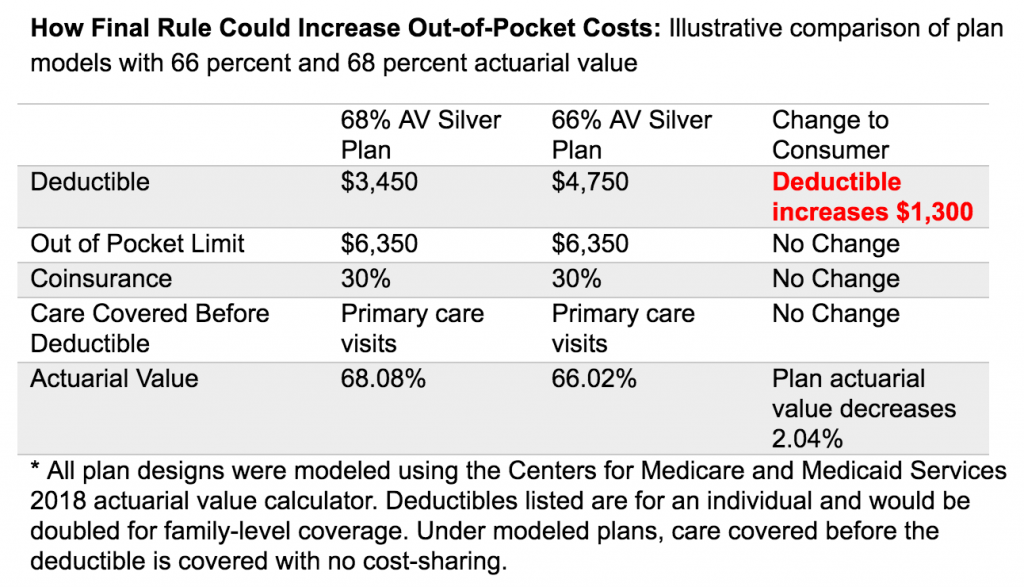

- Weakens cost-sharing requirements for marketplace plans, effectively increasing health insurance deductibles for many and reducing financial assistance with premiums: The Administration has finalized its proposal to allow insurers to sell marketplace plans with even higher deductibles and cost-sharing at every metal level than allowed today. Specifically, the final rule would reduce the minimum actuarial value of plans in each metal level by 2 percent. While 2 percent doesn’t sound like much, this translates into drastically higher cost-sharing. For example, Families USA did its own analysis of the potential cost impact of changing the minimum actuarial value of silver plans from 68 percent actuarial value to a 66 percent actuarial value, as finalized in this rule. We specifically measured the impact on plan designs that cover primary care before the deductible because in the past, most people in silver plans (85 percent) have picked plans that cover some care before the deductible. We found that this finalized policy could easily increase deductibles in the lowest value silver plans by more than $1,000.

- This change in actuarial value will also significantly reduce the amount of financial assistance that more than 8 in 10 lower- and moderate-income people receive to reduce their monthly premiums. This is because the amount of a person’s assistance is tied to the premium for the second-least expensive silver plan in their local market, and under this newly finalized policy, that assistance will very likely be tied to the cost of even lower-value, less-expensive silver plans. Center on Budget and Policy Priorities estimated that a family of four making $65,000 could have to pay $327 more in premiums each year under this new policy in order to avoid seeing their deductibles and other cost-sharing increase drastically. No matter how you slice it, families will face higher health care costs under this new rule, either through higher premiums to keep the plan they have today, or through higher deductibles and other out-of-pocket costs.

No matter how you slice it, families will face higher health care costs under this new rule, either through higher premiums to keep the plan they have today, or through higher deductibles and other out-of-pocket costs.

- Shortens the annual window for people to enroll in coverage: The Administration has finalized its proposal to cut future open enrollment periods in half, from November 1 to December 15 rather than November 1 to January 31. This is despite overwhelming comments from consumers, enrollment assisters, insurance agents, and state marketplace officials expressing concerns over this policy. This change will significantly limit the opportunity for people to become aware of their coverage options and enroll in coverage within the given timeframe. This essentially guarantees that fewer people will enroll in coverage. It will also very likely result in the enrollment of fewer healthy people—who are less aware of coverage options but would improve the risk pool for everyone.

- Creates more difficult processes to enroll throughout the year: The Administration has finalized its proposal to tighten rules for people enrolling in coverage outside of the open enrollment period. These “special enrollment periods” (SEPs) were designed for people to get coverage when they experience certain life changes, such as getting married, losing health coverage, or having a child. Under this finalized policy, consumers will have to prove their eligibility for an SEP before they enroll, a change that will create further roadblocks to consumers getting coverage. Fewer than 5 percent of consumers eligible for SEPs actually enroll in coverage, but when SEP rules have been tightened in the past, even fewer people enrolled due to the cumbersome process, particularly young adults who help balance the risk pool and bring down costs for everyone.

- Tightens rules around grace periods: The Administration has finalized its proposal to scale back the ACA provision that provides people who receive financial assistance with a 90-day grace period to pay their premiums. This change will put these individuals at risk of losing continuous coverage when they are unable to pay multiple months’ premiums in full. This can happen easily to people with tight budgets who experience a life emergency.

- Weakens federal standards for network adequacy: The Administration has finalized its proposal to weaken federal protections to ensure that consumers have access to necessary doctors and hospitals once they enroll in coverage. The final rule also weakens requirements for insurers to include providers in their networks who serve predominantly low-income, medically underserved populations. These changes will result in insurance enrollees traveling farther for care, waiting longer for appointments, and forgoing care or paying high out-of-network costs due to lack of in-network providers.

Overall, the final “marketplace stability” rule that the Trump Administration released yesterday will only harm health care consumers and weaken the health care system overall. Despite loud protests by the thousands who submitted comments and others around the country concerned about what this will do to the marketplace, the Trump Administration is moving forward with changes that will knowingly make it more difficult for consumers to obtain affordable coverage and care.

PRESS RELEASE: Trump Breaks His Promise Again: Makes it Harder for Families to get Affordable Health Care