King v. Burwell Consumer Profiles Part 1: Health Care At Risk (slideshow)

02.27.2015

On March 4, 2015 the Supreme Court will hear oral arguments on King v. Burwell, a legal case that threatens to strip premium tax credits from residents in two-thirds of states, thus putting 9.3 million low- to moderate-income Americans at risk of losing their ability to afford health care coverage.

We’re reaching out to consumers from across the country and asking them to answer one question:

What would happen to you if the Supreme Court rules in favor of the plaintiffs in the upcoming (March 4) King v. Burwell legal case, and residents like you—who live in states with federally facilitated marketplaces—lose their tax credit subsidies?

The short slideshow below shows how consumers feel about the prospect of losing their subsidies. In the coming weeks, we’ll be posting more profiles.

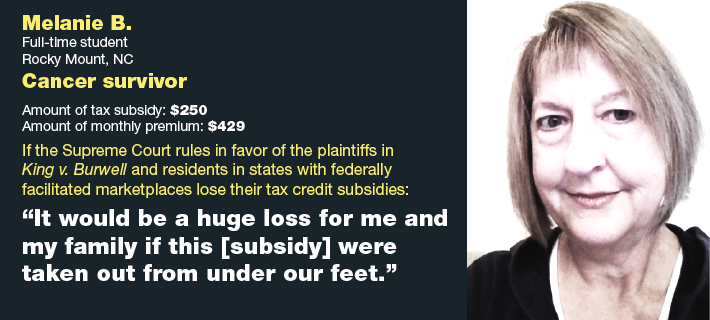

HEALTH CARE AT RISK (1 of 3)

Melanie B., North Carolina, Full-time student

Melanie, a cancer survivor, feels “blessed to have adequate, real insurance.” After losing her job, she took advantage of a job retraining program at a local community college. As she works toward her health information technology degree, Melanie’s tax premium subsidy is helping her invest in her future. (Share: Facebook | Twitter)

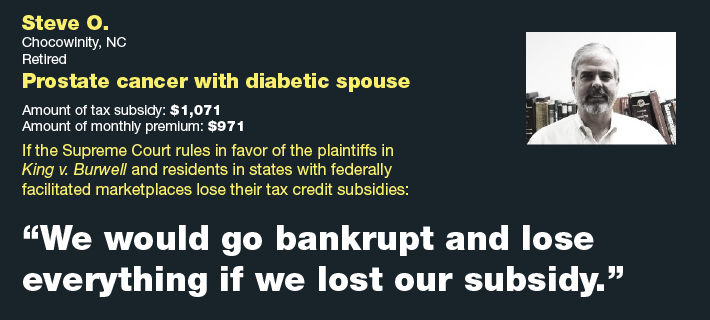

HEALTH CARE AT RISK (2 of 3)

Steve O., North Carolina, Retired

Steve was forced into early retirement after he was diagnosed with prostate cancer while his wife is an insulin-dependent diabetic. They had cashed out four life insurance policies to pay for their health care and an expensive policy for people with high-risk medical conditions. Their marketplace health insurance saves them thousands of dollars a year. If they lose their subsidy, Steve and his wife could run out of money in the long-term. (Share: Facebook | Twitter)

HEALTH CARE AT RISK (3 of 3)

Lori Z., Wisconsin, Small business owner

Lori runs a small business, but had trouble finding health coverage she could afford until she signed up for ACA insurance. Without a subsidy, money would be tight for Lori, who recently had treatment for breast cancer. While she was undergoing treatment, Lori had to decline some big orders, which cost her business. But once she got subsidies, she was able to save $230 per month (nearly the cost of her monthly premium)—a big relief for her. She’s happy to be able to be able to invest in her business once again. (Share: Facebook | Twitter)

You can find more videos, analysis, consumer stories, and background information on the King v. Burwell case here.