Federal Standardized Health Insurance Plans Could Help Improve Access to Care without Raising Premiums

By Lydia Mitts,

06.15.2016

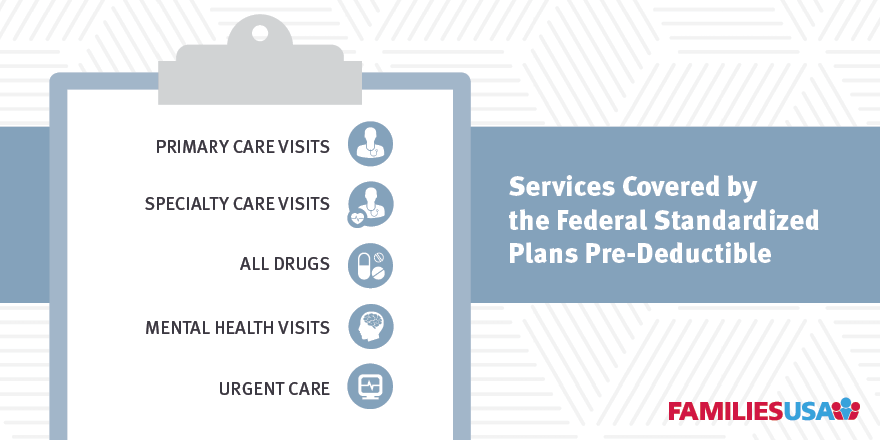

Health insurance companies should offer plans on the Affordable Care Act marketplaces that cover the cost of basic outpatient care—like primary care, specialty care, and prescription drugs—before people pay off their deductible. The new federal standardized silver plans, released by the Department of Health and Human Services (HHS) earlier this year, will do just that.

New, original research shows that federal standardized plans are a good deal for consumers who need a plan that covers basic health care services before they meet their deductible. Our report found that:

- The federal standardized silver plans would have premiums that are comparable to current silver marketplace plans that cover little to no services before the deductible.

- Offering these standardized plans could improve access to outpatient care without driving up premiums.

Families USA produced the report with Milliman, an independent actuarial firm.

Families USA believes that insurers in all 34 states with federally facilitated marketplaces should offer these plans in 2017 so that consumers in these states have access to these plan options. In 2018 and future years, we urge the federal government to require insurers in these states to offer the federal standardized plans.

Why are these standardized plans necessary? Because deductibles still pose a barrier to care for many insured consumers, causing them to forgo need health care.

How can standardized plans remedy this problem? These plans could help improve access to care for consumers who currently have few or no affordable plan options that help cover basic outpatient care before the deductible.