Congress to Challenge American Workers’ Health Insurance—Changing the Definition of a Full-time Worker and Other Proposals

01.08.2015

As the 114th Congress convened this week, conservatives in the House of Representatives acted quickly to take up a Republican bill that could weaken the Affordable Care Act (ACA). This bill is the first in a number of health care proposals that lawmakers may debate early in the session—some of which will seek to weaken the ACA and others that aim to continue programs that provide critical health coverage to consumers.

Threat: H.R. 30 redefines the definition of a full-time worker under the ACA

The House of Representatives easily passed H.R. 30, the Save American Workers Act of 2015, yesterday. The bill now goes to the Senate, where it has some support from Democrats. Whether that support is enough to garner the 60 votes required to pass the Senate remains to be seen (a presidential veto, however, is certain). The bill proposes to change the definition of full-time work under the Affordable Care Act from 30 hours a week to 40 hours a week, a move that many (including Families USA) believe could motivate some employers to cut worker hours in order to avoid providing them with health insurance.

How H.R. 30, the Save American Workers Act, could reduce American workers’ hours

This week, the Center on Budget and Policy Priorities (CBPP) released a new report explaining precisely how American workers could be affected by H.R. 30. According to CBPP, the bill would do exactly what conservatives have been decrying—it would create a greater shift toward part-time work. Here’s how.

Currently, the ACA requires employers with 50 or more employees to provide health insurance to full-time workers—those who work at least 30 hours per week.

If this legislation passes both the House and Senate and is signed into law (the White House, however, has indicated that it will veto H.R. 30), the ACA would define a full-time worker as someone who works 40 hours per week, not 30. To reduce the number of employees for whom they’d be legally required to provide health insurance, employers could simply cut workers hours to avoid the 40-hour-per-week threshold. And that’s a big concern.

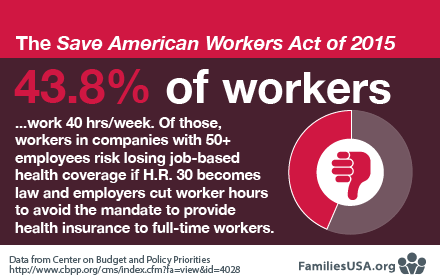

The CBPP report further found that changing the definition of a full-time worker from 30 to 40 hours will likely affect many more jobs—and employees. While just 7.4 percent of Americans work 30 to 34 hours per week, a much higher number—43.8 percent—work 40 hours per week. Many of those 43.8 percent would be at risk of employers cutting their work hours.

43.8 percent of Americans work 40 hours per week. Of those, workers in companies with 50+ employees risk losing their job-based health coverage if H.R. 30 becomes law and employers cut employee hours in order to avoid the mandate to provide health insurance to full-time workers.

Additionally, the nonpartisan Congressional Budget Office calculated that the H.R. 30 billwould force 1 million consumers to lose their job-based health insurance, adding 500,000 more people to the ranks of the uninsured.

The CBO further reports that H.R. 30 would increase the federal deficit by about $53 billion in over ten years because—upon losing their job-based health insurance—more workers will rely instead on publicly funded health programs such as Medicaid, CHIP, and premium subsidies from the health insurance marketplaces.

Threat: Repealing the medical device tax

Over the next few weeks, we’re also likely to see Republicans in Congress propose additional incremental changes to the Affordable Care Act. One proposal targets the health law’s 2.3 percent tax on medical devices, a financing mechanism for the Affordable Care Act.

How the medical device tax works

Funding for the Affordable Care Act was designed to ensure that industries which benefit from health reform—including the medical device industry—should help fund it, particularly because the new law would bring millions of new consumers—and financial profit—to the health care industry.

In part, this would lead higher to demand for medical devices—from surgical gloves to CT scans. The sale of those devices would generate a 2.3 percent tax to help fund the ACA.

Repeal of the medical device tax has garnered support from both Republicans and Democrats in Congress, who claim that the tax will stifle economic growth and result in a loss of jobs in the medical device industry. Supporters of the tax (including Families USA) find this argument to be anecdotal and not based on extensive or comprehensive research.

Earlier this week, a Washington Post reporter expressed her skepticism on these claims as part of the Post’s “Fact Checker” series: “The evidence for that is pretty skimpy, unless one just wants to pick and choose a few companies. At the very least, citing a single (and relatively small) tax as the sole reason for current and future job cuts in the volatile industry is a misrepresentation.”

Repeal of the medical device tax would cost close to $30 billion over 10 years. We are concerned about how Congress would try to offset this cost—possible offsets could be harmful to the Affordable Care Act or other health care programs that benefit low- to moderate-income consumers.

For these and other proposals, remember that—in order to become law—supporters must secure 60 votes in the Senate for passage and President Obama must sign them.

Opportunity: Extending funding for CHIP

The new Congress has the opportunity to take actions that would bolster health care in the first quarter of 2015—such as extending funding for CHIP, the Children’s Health Insurance Program. While CHIP is authorized through 2019, current funding for the program expires on September 30, 2015.

Congress must act quickly to extend funding for CHIP so that states feel comfortable including funding for the program in their budgets, as CHIP relies on a federal-state funding partnership. Without Congressional funding, 8 million children from low- to middle-income families who rely on the program could see their health coverage disrupted.

Check out the plenary (Friday, January 23) and workshop (Thursday, January 22) sessions on CHIP at our upcoming conference, Health Action 2015.

Opportunity: Fixing the Medicare Sustainable Growth Rate (SGR)

Another item that Congress must address early in 2015 is either a patch or a permanent fix to the Medicare Sustainable Growth Rate (SGR), also known as the “doc fix.” The SGR is a formula that was created as part of a 1997 deficit reduction law designed to rein in federal health spending. It links physician payment to an economic growth target—and each year Congress has delayed the scheduled cuts in physician reimbursement rates.

The current SGR patch expires on March 31, 2015. When the SGR is extended again (or permanently fixed) we recommend that lawmakers continue to fund the following important health extender programs as part of an SGR package:

- the Qualified Individual (QI) program, which helps low-income Medicare beneficiaries afford their monthly premiums and out-of-pocket costs

- the Transitional Medical Assistance (TMA) program, a Medicaid program that provides up to one year of additional Medicaid health insurance benefits for certain low-income families that would otherwise lose coverage.

These are still early days for the new Congress and these are by no means all the health care proposals that we expect to see. We’ll continue reporting about new proposals and what they mean for the Affordable Care Act, Medicaid, CHIP and consumers.