All it takes in anybody’s life is one bad diagnosis. You go without health insurance, you have a biopsy. Next thing you know, you’re looking at $500,000 worth of treatment. How are you going to pay for that? You can’t.

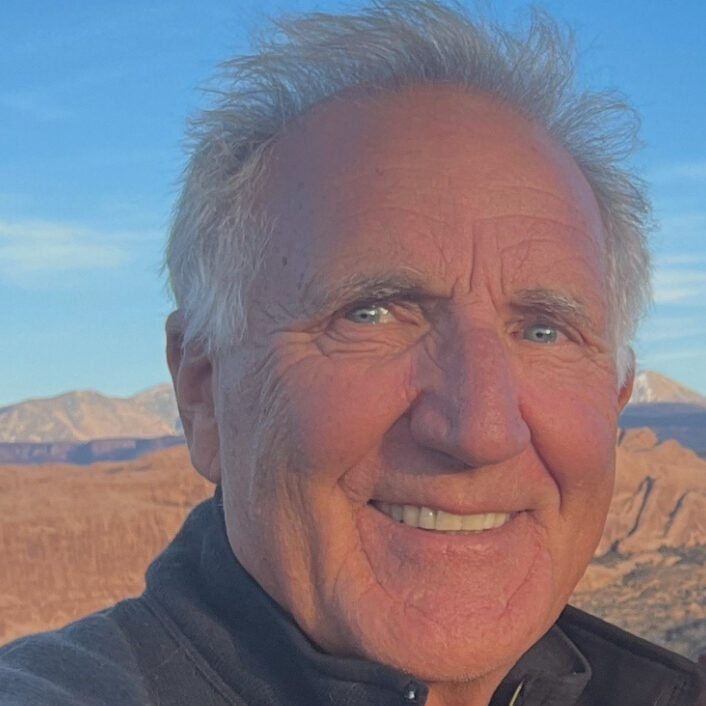

Charlie Kulander is a 71-year-old resident of Moab, Utah. He and his wife moved to the state in 1989 and raised two children while building a career as a travel writer. He worked as a contributing editor at National Geographic Traveler and collaborated with Expedia and other companies, traveling extensively while using Moab as a base.

In 2008 their lives changed forever when both Charlie and his wife were diagnosed with cancer. Charlie set aside his travels to devote himself to caring for his wife, who he tragically lost in 2017. As they faced their diagnoses, Charlie’s experience with health care became urgent and deeply personal. Their pre-existing conditions trapped them in an insurance plan, “We thought we were doing everything right. But then, we couldn’t leave the plan because no other plan would accept us because all of a sudden, we were saddled with the cancer diagnosis,” he said. The combination of soaring premiums and staggering out-of-pocket costs pushed the family toward financial collapse. “We were basically on the verge of bankruptcy dealing with all of this, which only adds stress to the situation,” Charlie recalled.

The passage of the Affordable Care Act in 2010 offered hope. Charlie studied the law, followed its progress, and when it became active in 2014, he immediately became involved. “I became kind of evangelical about it. So, I held meetings with people down here and public meetings trying to explain the Affordable Care Act. I became a navigator,” he said. Charlie later obtained a broker’s license, allowing him to help people enroll in the health insurance marketplace in Southeastern Utah.

Charlie has seen the marketplace face numerous challenges, and he worries about its future. He explained the risk if the ACA’s enhanced premium tax credits were not extended. “It would affect the entire community. We have a large number of people on the health insurance marketplace down here in the Moab area because it’s basically a service economy. You don’t usually get health insurance with your job down here.” Without subsidies, he expects many residents to drop coverage, driving up costs for those who remain. “So, a lot of people are just going to drop out of the marketplace and they’re going to tough it out and just go to the emergency room when they have to and delay medical care, I suppose. There are no other options.”

Charlie emphasized the financial consequences for families over 400 percent of the federal poverty level. “Somebody who’s making 63,000, you look at their take-home pay, which is going to be under 50,000, there’s no way they’re going to be able to afford paying $1,200 to $1,300, $1,400 a month for a health insurance policy. They just can’t do it. And there’s no other alternative down here.” He said even a short-term loss of coverage could devastate households, speaking from his own experience with his and his wife’s cancer. “All it takes in anybody’s life is one bad diagnosis. You go without health insurance, you have a biopsy. Next thing you know, you’re looking at $500,000 worth of treatment. How are you going to pay for that? You can’t. You’re going to run through all your assets.”

Charlie described Moab as a city where most residents earn modest incomes in the service and tourism industries. Health insurance costs are high, housing and rents are expensive, and older residents face particularly steep premiums. “Those people that are closest to going into Medicare are facing the biggest prices. They’re looking at paying astronomical premiums between age 55 and 65. I don’t know a lot of them how they’re going to do it,” he said. He expects roughly 30 percent of his clients to drop coverage if subsidies expire.

Reflecting on the broader implications, Charlie said, “Health insurance is a complicated business. The marketplace has its own set of arcane rules and cost-sharing reductions and this and that. I’m just afraid a lot of politicians don’t quite understand the gravity. All they think about is, oh, enhanced subsidies. Let’s get rid of that and just go back the way it was because the way it was workable. It isn’t workable anymore given the rising prices of the premiums.”

Charlie credits the ACA with stabilizing his life during his family’s most challenging years. “It allowed me to get my life back. We were in the midst of putting kids through college, all the expenses of a family. If I didn’t have the Affordable Care Act, more than likely, my kids wouldn’t have gone to college, and we would have been forced to declare bankruptcy. I owe my present life in a lot of ways to the passage of the Affordable Care Act.” Even after aging into Medicare, he continues to work with the ACA as a navigator and broker, advocating for the critical support it provides. “It’s such a key, crucial part of everybody’s life who doesn’t get employer-sponsored insurance or Medicaid that to see what’s being done to it is just a travesty, and it tears me up.”

Add your voice to help us continue to push for the best health and health care for all.

SHARE YOUR STORY