Rate Review FAQ

What is a rate filing?

Documents submitted by an insurer to state oversight agency (generally the Department of Insurance but in some cases, as in California, may also be another body such as a Department of Managed Health Care) or HHS. The rate filing contains the information justifying, or purporting to justify, the rates the insurer seeks to charge

What is a rate?

Rates are the base from which individual health insurance premiums are established based on the few individual factors allowed under the Affordable Care Act: age, geography number of covered family members, and tobacco use. States are allowed to ban age and/or tobacco rating, and some states have done so. California, for example, has banned tobacco use as a factor.

Base Rate

(justification

applies to this)

+

Rating factors

(if allowed by State):

Age

Geography

Tobacco

# of covered

family members

=

Final

Premium

What is “rate review”?

Once insurance carriers submit their rate filings, the state regulator (or HHS) must review filings with an eye towards whether proposed rates are reasonable. In most states, regulators assess whether the increase is excessive, unjustified, or unfairly discriminatory. In states that have been found “ineffective” in their review process, HHS reviews the filings. Some state regulators have the authority to reject a proposed rate increase if rates are found to be unreasonable under state law. HHS does not have this authority.

How do I follow the rate review conversation on twitter?

Use hashtag #ratereview to see the ongoing conversation on health insurer rates. Please join the conversation with your own comments on rates, too.

Which States Don’t Have Effective Rate Review?

The Affordable Care Act sought to make rate justifications more transparent by creating a role for HHS when states lacked “effective” rate review programs. Click here to see which states are designated by HHS as having effective rate review programs. Please note, however, even among states designated as having effective review by HHS, there is tremendous variation in their ability and willingness to scrutinize justifications and request lower rates.

How can the public weigh in on rate filings?

The public’s ability to weigh in varies by state. This chart shows the degree of public participation allowable in each state, along with relevant statutes and links to states’ rate review web pages (where available). Consumers Union and Families USA have resources to help the public assess rates.

How do I see the rate filings in my state?

If information on rate filings is publicly posted, you will find it on your state’s health insurance website. This chart links to these websites, and also details your state’s procedures for making the information public and opportunity for public comment. If your state does not make the complete filing available, you can file a public records act request to the state regulator or Freedom of Information Act request to HHS in the case of states that don’t have effective rate review programs. If your claim is rejected on trade secret grounds, please contact our experts through Kara Kelber at kkelber@consumer.org or Dave Lemmon at dlemmon@familiesusa.org for assistance rebutting these arguments.

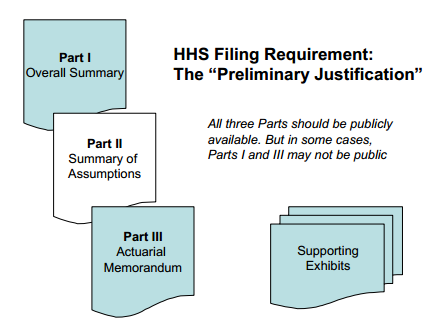

What rate filings are available from HHS?

When an increase is requested, carriers are required to send Parts I and III of the justification to HHS. When the increase exceeds a certain threshold – currently set at 10% – Part II of the filing is also sent to HHS. These documents may not be available to the public, however. This page contains the latest available information.

Why is public participation important?

Independent scrutiny of rate filings and calling out questionable assumptions by carriers—e.g. overly high medical trends—creates pressure to reduce requested rates. There are many examples of how media coverage and consumer group comments resulted in carriers offering to reduce rate requests or regulators giving very close scrutiny.1

Resources

Documents

- CALPIRG Report: California Health Insurance Rate Review (2014)

- Consumers Union Updated Health Insurance State Rate Review Toolkit (2014)

- Consumers Union 50 State Overview: Statutes, Type of Rate Review and Public Participation (Draft)

- Consumers Union 50 State Overview: Conditions under Which Rate Review Hearings Held (Draft)

- Consumers Union 50 State Overview: Public Access to Rate Filing (Draft)

- Consumers Union Rate Review Glossary

- Families USA Issue Brief: States Making Progress on Rate Review (2011)

Blogs

- Families USA 2014 blog series on Challenging Health Insurance Rate Increases. This is the link to the first blog in the series, and it in turn links to the others.

- Consumers Union Blog post #1 for consumers: Insurance rates are being filed, consumers need to pay attention (2014)

- Consumers Union Blog post #2 for consumers: Figuring out health insurance rate requests is getting simpler, and you can weigh in! (2014)

- Consumers Union Blog post #3 for consumers: No more excuses! Distinguishing “need” from “desire” when insurers want to raise rates (2014)

- Consumers Union Blog post #4 for consumers: Trend setters: how much does the cost of health care increase each year? (2014)

- Families USA Blog post: New Report Showcases Large Premium Savings Due to Rate Review Provision in Affordable Care Act (2012)

- Families USA Blog post: Holding Health Plans Accountable for Your Premium Dollars (2010)

1 In Colorado, the Colorado Consumer Health Initiative notes that rate review saved consumers as much as $32 million in one year. In Oregon, OSPIRG estimates that rate review cut at least $69 million from 2014 premiums. And in California CalPIRG estimates that rate review between 2011 and 2014 has saved $349 million. Click here for more.

Consumers Union is the public policy and advocacy division of Consumer Reports. Consumers Union works for health reform, food and product safety, financial reform, and other consumer issues in Washington, D.C., the states, and in the marketplace. Consumer Reports is the world’s largest independent product-testing organization. Using its more than 50 labs, auto test center, and survey research center, the nonprofit rates thousands of products and services annually. Founded in 1936, Consumer Reports has over 8 million subscribers to its magazine, website, and other publications.